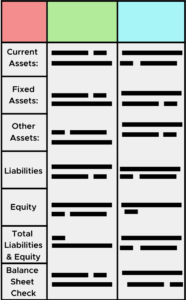

A balance sheet is one of the least reviewed financial statements in a small business. Yet, it shouldn’t be. Your balance sheet is important for a number of reasons:

-

-

-

-

-

-

- It tells you how healthy your business is. Specifically, what you own versus what you owe. Your balance sheet can tell you whether or not you have sufficient assets to cover your liabilities.

-

-

-

-

-

-

-

-

-

-

-

- It works as a checks and balance tool for your profit and loss statement. If you have an accurate balance sheet, you can be more confident in the accuracy of your P&L results.

-

-

-

-

-

-

-

-

-

-

-

- It is a key tool used by banks and investors to evaluate the health and performance of the business

-

-

-

-

-

Business Health Check Using Your Balance Sheet

When reviewing your balance sheet, you can gain an understanding of how healthy your business is by reviewing your assets vs liabilities. For example, if you have $500,000 in cash and only $200,000 in liabilities, you’re in a pretty health position. If, instead, those figures are flipped and you have $500,000 in liabilities, but only $200,000 in cash, you are more highly leveraged and more at risk of financial trouble if you see a downturn in business.

For some businesses, those that have a significant level of Cost of Goods Sold to produce revenue, it’s important to review your Accounts Receivable vs. Accounts Payable (AP) balances. It is common to have a higher AP balance when you have high materials and subcontractor costs, however, you don’t want the AP balance to get out of line with your AR balance. If you run at a 40% margin, for example, you want to typically see an AR balance that is 40% higher than your AP balance.

Checks and Balances

Your balance sheet can help you determine if your profit and loss results are reasonable. If you have an error in your accounting and a transaction gets recorded inaccurately to a balance sheet account instead of a profit and loss account, you can have inaccurate financial results on your profit and loss.

If you review your balance sheet and understand what every balance is, tie the balances out to support, and ensure there aren’t balances remaining that should no longer be there, this increases the likelihood that your P&L is accurate. For example, if you review your balance sheet and find that there is a bank account balance that you know you no longer have or you know the balance is wrong, it’s possible that you recorded something to an incorrect account and your expenses may actually be higher than you thought, reducing your net income on your P&L.

Knowing that the balances on your balance sheet are accurate will help you feel comfortable in your P&L results.

Evaluation Tool for Banks and Investors

When a bank is evaluating your business for a loan or an investor is considering your business for their next cash injection, they will use the balance sheet to evaluate the risk. P&L performance is important; however, liquidity and leverage are also important factors for them to consider.

If your balance sheet shows that you are highly leveraged (your liabilities significantly outweigh your assets), the bank or investor is going to have a harder time feeling comfortable with the loan or investment. They may add a premium to the interest rate or equity percentage based on their comfort-level with the balance sheet.

Your balance sheet is a key financial tool that you should be reviewing regularly to ensure the health of your business, the accuracy of your financials, and your ability to attain financing or investment.