At least once per year, if not any other time, you’ll get asked whether or not you operate your business using accrual or cash-basis accounting. Since this question typically arises at tax time, most think that this is just a tax question to be answered by your CPA. However, analyzing your business performance requires an understanding and review of both methods.

For tax purposes, the simple definition of accrual vs. tax is that accrual-basis companies will pay taxes when revenue is earned (the work is done) and expenses are incurred (you have received the good or service), regardless of whether money has changed hands. For example, if you completed a large project on December 14th and billed your client $100,000, but they don’t pay until January 6th, you will pay taxes on that income in the year it was billed if you are an accrual basis tax payer – the money was earned, even though it was not yet received. Alternatively, if you were a cash-basis tax payer, the income would be reported the following year when received. (Note: there are various IRS requirements for when you must or must not report your income one way or the other).

Regardless of your reporting for tax requirements, if you are a cash-basis tax payer, it is important that you additionally analyze your business using an accrual method of accounting.

Here’s why:

You have a client that pays you in December for a year-long project to start in January. For tax purposes, you recognize the income. You look to have an extremely healthy year. However, the expenses relating to that project all occur throughout the next 12 months, including labor, supplies, software, and other costs. Your costs are equal to 50% of the fee. Because you do not have any other significant projects that prepay you in the next year, but you have all of the costs of this large project, the next year will look far worse than it actually is. While this example may seem straight forward and easy to explain, if this is happening with much smaller projects, but happening over and over again, your financials may not be telling you an accurate story of your business performance. You want make sure you are analyzing your business performance by reviewing actual revenue earned and actual expenses incurred in the period that they are occurring. This will help you to know how your business is truly performing.

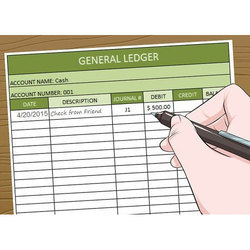

If you are using an accounting system and using it appropriately, you should be able to convert from accrual to cash fairly easily, but be careful not to run an accrual financial statement without understanding your inputs. If you’re not using the right inputs, you may think you’re looking at an accrual P&L, and make decisions as such, only to find out later it was not accurate. Accrual-basis financials are going to help you analyze how your business is really performing, not just how the money is flowing.

Note: GAAP (Generally Accepted Accounting Principals) financials are going to be accrual-basis financials that also follow very specific rules for depreciation, capitalization, and financing. When you are providing financials to an outside party, make sure you detail what you are providing.

Shauna Huntington, President

Posted in Small Business Accounting