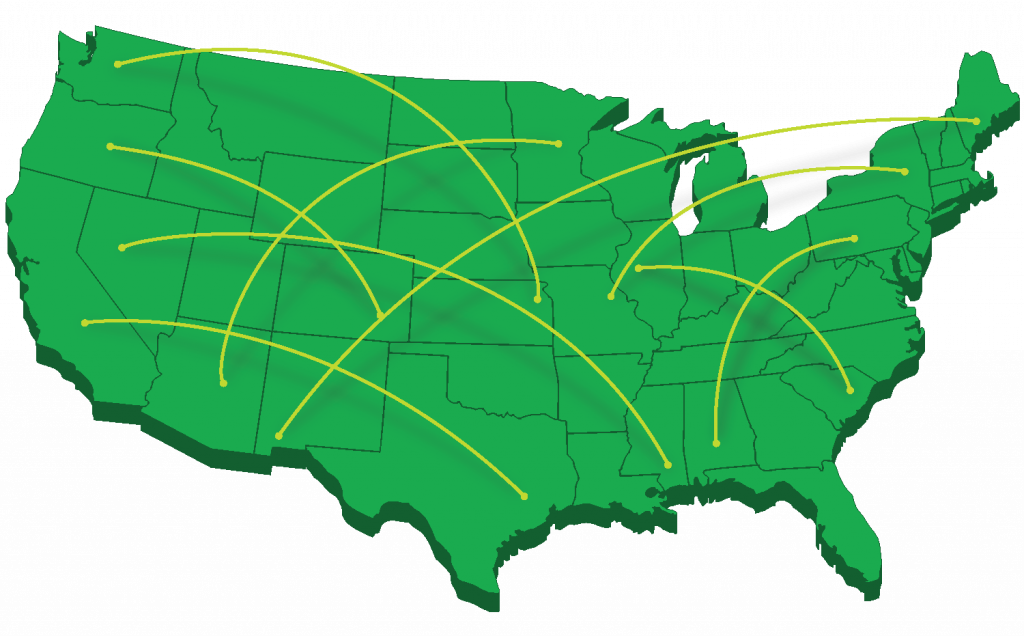

Crossing state lines can grow your business. However, as an employer, it also means you must be aware of the different laws related to employment and business in each state.

First, you need to be aware of whether states have reciprocal agreements. Reciprocity means states have agreements that you may withhold payroll taxes only for one state, even if your employees live in a different state than which they work. However, if states do not have reciprocity, you will need to determine how to withhold taxes correctly for each state.

Second, if an employee works in multiple states, you must track the work completed in each. For example, if you live near a state line and perform work in multiple states, an employee may work one day in one state and the next in a different. You must track this this effectively and split paychecks between locations if necessary. This can also be an issue if your employees travel for work. States have different rules to determine when the time spent in another state would be required to be reported as such. This may require that you report wages to multiple states for the same employee. Employees also need to be made aware that they will have to file income tax returns in each of those states.

It is important to keep comprehensive payroll records for employees. These records should outline where work is performed, the number of hours spent in each location, and where the income and withholding is reported. Even if employees are paid on a salary, work locations and hours should be tracked to ensure proper reporting.

Employing team members in multiple states can be tricky. You can find more information regarding how to handle multi-state payroll issues from the American Payroll Association.

Erin Ryan, Controller

Posted in Payroll and Benefits, Tax Law