At Fortiviti, we understand that keeping up with new regulations can feel overwhelming, especially when it involves unfamiliar terms or processes. The Corporate Transparency Act (CTA) is one such regulation, designed to increase transparency around who really owns and controls companies. Enacted in 2021, this law aims to prevent illegal financial activity by ensuring businesses disclose who truly owns the business. If your business is affected, here’s what you need to know to stay compliant and avoid costly penalties.

What Does the Corporate Transparency Act Require?

The CTA requires certain companies to file what’s called a Beneficial Ownership Information (BOI) report with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). In plain terms, a “beneficial owner” is anyone who either owns or controls at least 25% of a company or has significant influence over the business’s decisions. The BOI report asks for key information about these individuals, ensuring the government knows who is really in control of U.S. businesses.

Who Needs to File?

There are two categories of businesses that must file:

- Domestic Reporting Companies – This includes U.S.-based corporations, limited liability companies (LLCs), or any other business entities that had to file paperwork with a state (such as articles of incorporation) to officially exist.

- Foreign Reporting Companies – These are companies formed in another country but legally registered to do business in the U.S.

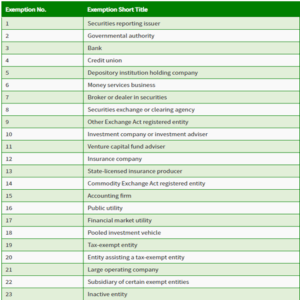

However, not all companies are required to file. Some businesses, like banks, credit unions, large corporations, or insurance companies, are exempt. There are 23 specific exemptions (see the list for details), so if you’re unsure, it’s worth checking whether your company qualifies for one of these exemptions.

Filing Deadlines and Frequency

Timing is key here. If your business was created before January 1, 2024, you need to file your BOI report by January 1, 2025.

- New businesses formed in 2024 will have 90 days from the time they receive public notice that their company has officially been created to file their report.

- For companies formed after January 1, 2025, you’ll need to file within 30 days of registering your business.

The good news? This isn’t a report you have to file every year. Once you submit it, you’re done—unless there are changes to your beneficial ownership or you need to correct something. In that case, you’ll need to update your report. Note that there is no requirement to report a company’s termination or dissolution.

What Information Should You Report?

The BOI report is pretty straightforward. For each beneficial owner—that is, anyone with significant control or ownership of the company—you’ll need to provide:

- Full legal name

- Date of birth

- Current residential address

- A unique ID number (such as a passport number or driver’s license number)

This ensures the government has a clear picture of who controls the business.

How to File

Filing your BOI report is designed to be quick and painless. You can do everything electronically through FinCEN’s secure website, and best of all, it’s free.

Penalties for Non-Compliance

We get it—compliance isn’t always at the top of everyone’s to-do list, but trust us, you don’t want to miss this deadline. If you fail to file on time or submit incorrect information, you could face:

- Civil penalties of $500 per day, up to a maximum of $10,000

- Criminal penalties of up to two years in prison for willful violations

And it’s not just the company that’s on the hook. Senior company officers can be held personally liable if their company fails to comply with the requirements.

Resources to Help You

Don’t worry—there’s plenty of help available. FinCEN has put together a Small Entity Compliance Guide to walk businesses through the filing process in simple, plain language. You can also find helpful videos, webinars, FAQs, and direct contact information on FinCEN’s website .

One Important Note: Watch out for scams! FinCEN does not send unsolicited requests for BOI information, so be cautious of any emails or calls asking for your business’s information.

Written by: Joyce Dryden & Shauna Huntington

Posted in General, Small Business Resources, Tax Law