Small Business Accounting

Reviewing your Financials: Top Five Things to Look For

If you’re getting regular monthly financial statements in your business, you’re already ahead of many business owners. But financial reports are only as good as the time you put in...

Outsourcing Your Accounting: How to Make it Work

Outsourcing is becoming a more common practice in business. Whether it’s marketing, accounting, sales, or even operations, outsourcing has become easier than ever. But, outsourcing only works if you do....

Understanding Employee Ownership as an Incentive

When you have a key employee that has been critical to your business success, you may want to incentivize them to stick around. Some business owners will look at ownership options...

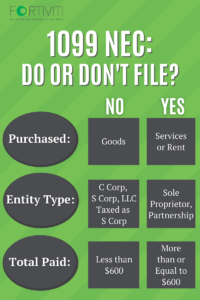

1099-NEC: To File Or Not To File?

It’s a magical time of year, to start fresh and set new goals for you and your company! After you’ve looked ahead at the year to come and all the...

Spooky Accounting Stories – Owning a Business versus Running a Business

You’re the best in the business, but you never went to business school… Many business owners “fell into it” because they turned their passion into a business. After all, if...

Spooky Accounting Stories: Mistreatment of Intercompany Transactions

Picture this – you’ve built your company from the ground up, and now you’ve got multiple legal entities, separated for tax purposes, tracking purposes, and maybe you want to sell...

Spooky Accounting Stories: Missing an Employee’s Payroll

This month we’re highlighting the spookiest of accounting stories that we hope you never have to experience. If you think you’re at risk for any of these situations, you may...

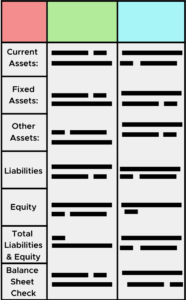

Your Balance Sheet: Why It’s Important

A balance sheet is one of the least reviewed financial statements in a small business. Yet, it shouldn’t be. Your balance sheet is important for a number of reasons: ...

Accrual vs Cash: Which Is A Better Business Practice?

The key component to accrual versus cash is that you are matching your revenue to your expenses. Basically, recording that revenue when you have earned it and recording those expenses...

Why Keep Receipts?

In business, it is important to have good records. However, in the day-to-day dealings of running a business, some smaller things, like receipts for expenses, seem to move to the...