Blog

How to Hold Effective Team Meetings

Team meetings are essential to running a successful business. The entire team needs to have effective communication. We get asked a lot about how often and how long meetings should...

The Importance of Tying out 941 to W2s

The new year is an exciting and busy time for small businesses. You are analyzing and reviewing the past year as well as planning for a successful year. With all...

Setting SMART Goals

A goal without a plan is just a dream. As we near the start of a new year and think of the accomplishments we want to achieve, it’s important to...

New Salary Requirements for 2020!

A few years ago, the Department of Labor (DOL) was set to increase the minimum salary requirement for allowing an employee to be exempt from overtime requirements. The increase was...

Employment Applications – Salary History

On May 23, 2019 the Kansas City, MO City Council passed a law prohibiting employers in KCMO to ask applicants about their salary history. This ordinance is effective as of...

Why Keep Receipts?

In business, it is important to have good records. However, in the day-to-day dealings of running a business, some smaller things, like receipts for expenses, seem to move to the...

NEW Tax Estimation Calculator

Did you get the refund you were expecting last year? The IRS has always had an estimated tax calculator for tax payers to use in order to estimate their taxes...

Changing Your Business Name – What You Need to Know

Congrats on your business name change! You’ve put in hours of brainstorming, writing, re-writing, and crafting to come up with your new name and brand. But now that you have...

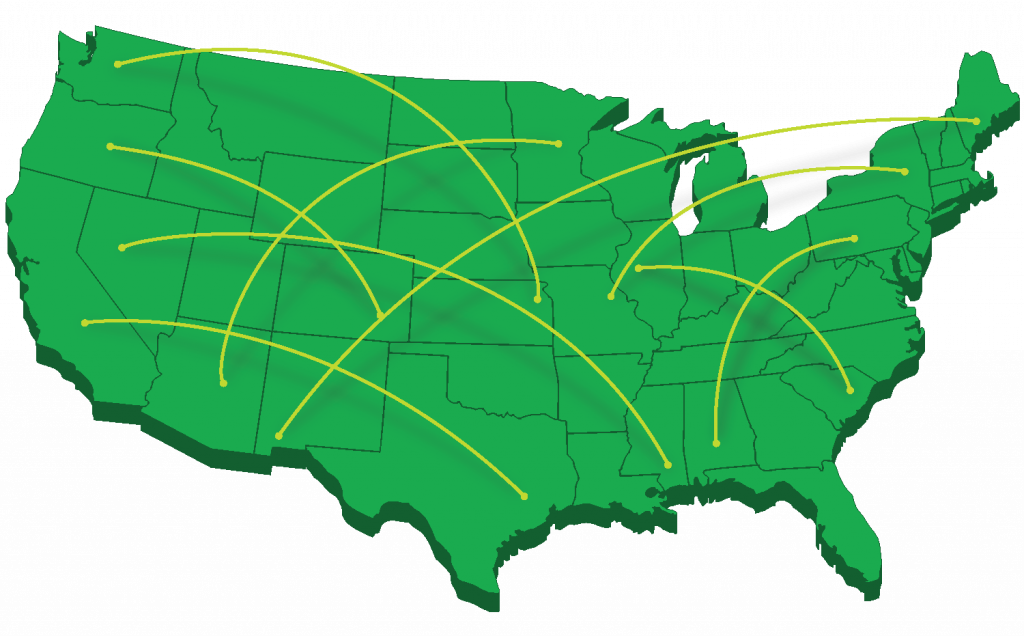

Crossing State Lines – Employment Considerations

Crossing state lines can grow your business. However, as an employer, it also means you must be aware of the different laws related to employment and business in each state....

Time For a Review of your Insurance Coverage!

When was the last time you reviewed your insurance? If it's been awhile, it's time to review. Insurance policies tend to be one of those things...