It’s that time of year! Small business owners must prepare for one of the most critical aspects of running a business – income taxes. Staying on top of deadlines and maximizing available tax breaks can save time, money, and stress.

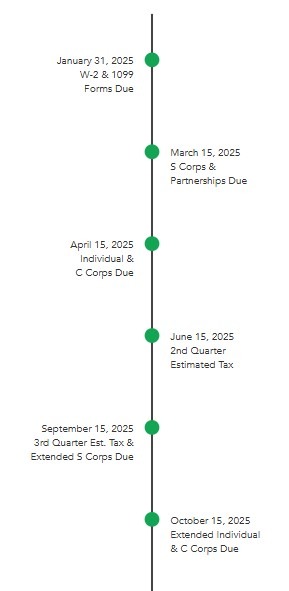

Important Tax Deadlines for 2025

- January 31, 2025: Deadline to file W-2 forms for employees and 1099 forms for contractors.

- March 15, 2025: Tax filing deadline for S Corporations and Partnerships (Form 1120S and Form 1065).

- April 15, 2025: Filing deadline for sole proprietors and C Corporations (Form 1040 and Form 1120). Also, the deadline for first-quarter estimated tax payments.

- June 15, September 15, and January 15 (2026): Deadlines for second, third, and fourth quarterly estimated tax payments.

- September 15th, 2025: Final deadline for extended partnership and S Corporation tax returns (if extension was filed by March 15th).

- October 15, 2025: Final deadline for extended individual and corporate tax returns (if an extension was filed by April 15th).

Essential Tax Breaks for Small Businesses in 2025

- Section 179 Deduction:

Businesses can deduct the full cost of qualifying equipment or software purchased in 2025 instead of depreciating it over time. This is particularly useful for businesses making significant investments in equipment or technology. - Qualified Business Income (QBI) Deduction:

Eligible small businesses can deduct up to 20% of their qualified business income, reducing taxable income for pass-through entities like LLCs, S Corporations, and sole proprietorships. Eligible taxpayers can claim the deduction for tax years beginning after December 31, 2017, and ending on or before December 31, 2025. - Work Opportunity Tax Credit (WOTC):

A credit available to employers who hire individuals from certain target groups, such as veterans or long-term unemployed workers. - Home Office Deduction:

Small business owners working from home can deduct a portion of their mortgage, rent, utilities, or other home-related expenses if a dedicated space is used exclusively for business. - Energy-Efficient Tax Credits:

Small businesses that invest in energy-efficient building improvements or equipment may qualify for credits under programs like the Energy Efficient Commercial Buildings Deduction. - Research and Development (R&D) Tax Credit:

Businesses investing in product development, software improvements, or innovative processes can benefit from this credit, which offsets costs associated with innovation.

Pro Tips for Tax Season Success

- Start early: Gather financial documents well in advance to avoid last-minute stress.

- Consult a professional: Work with an accountant or tax advisor to ensure compliance and maximize deductions.

- Keep accurate records: Maintain detailed records of expenses, invoices, and receipts throughout the year to support claims during tax filing.

- Use technology: Invest in accounting software to simplify bookkeeping and streamline reporting.

Tax season doesn’t have to be stressful. Knowing the key tax deadlines for 2025, understanding standard tax breaks, and working with a professional, small business owners can avoid the headache.

Posted in Accounting Infographics, General, Small Business Accounting