It’s a magical time of year, to start fresh and set new goals for you and your company! After you’ve looked ahead at the year to come and all the great things you have planned, don’t forget that it’s also tax season. While that means a lot of different things to different people, there’s one aspect of tax season that can be easily overlooked since it’s often a business owner’s responsibility – 1099’s.

A 1099 is an IRS tax form that is used to report non-employment income. This income is derived from services rendered by an individual or a business that files taxes as an LLC or sole proprietor. We’re going to focus on the 1099-NEC, since this is a very common occurrence for small businesses, and we’re going to describe the process from the point of view of a business owner, who needs to file 1099’s to contractors that provided services to them.

What is the 1099-NEC?

1099-NEC stands for Nonemployee Compensation. This is to say that you received services from someone that is not already on your payroll and that you don’t have to pay employee benefits to.

What do you need from a Contractor?

In order to tell if you need to send a contractor a 1099-NEC, you must obtain their W-9. This is an IRS tax form that the independent contractor fills out to let the company what their Federal Tax Classification is – Individual/sole proprietor or single-member LLC; C Corporation; S Corporation, Partnership; Trust/estate; or Limited Liability Corporation taxed as a C Corp, S Corp, or Partnership. This form also has the contractor’s Tax Identification Number, which is needed to file the 1099-NEC.

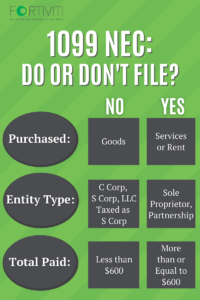

Who gets a 1099-NEC?

A contractor that is taxed as an Individual/sole proprietor or single-member LLC or a Limited Liability Corporation taxed as a Partnership are the entity types that would require a 1099-NEC to be filed. If the contractor provided some type of service to you, whether that’s business services, attorney services, or renting equipment to you. You’re also only required to submit a 1099-NEC to a contractor that you’ve paid over $600 to for the period 01/01/2021 – 12/31/2021 and that you paid via check, direct deposit, or cash. If you paid a contractor via PayPal/Venmo/other payment processor, credit card, or debit card, then you don’t need to submit a 1099-NEC because that payment processor will be doing so on their end.

How can I start my 1099 analysis with QBO?

1099’s are the responsibility of the business – typically tax CPA’s do not file these for you. QuickBooks Online has a handy 1099 Wizard that, if your QBO information is clean and accurate, will allow you to calculate the amount to put in your 1099-NEC with no problem. On your QBO menu, select Taxes à 1099 filings and begin the wizard. Just make sure that you have selected the “Track payments for 1099” option in your Vendor Information screen for all vendors, and be sure you’re coding the expense types as Credit Card, Debit Card, Check, etc., for each payment to the contractor so that QBO knows to exclude those payment methods that aren’t required to be filed.

Deadlines

1099’s must be filed with the IRS and must be to your vendors by January 31, 2022. Be sure to use the 2021 form for 1099’s, as the IRS makes changes yearly.

Links to resources for filing:

https://www.irs.gov/forms-pubs/about-form-1099-nec

https://www.irs.gov/pub/irs-dft/f1099nec–dft.pdf

Written by: Mandy Prather